What is a 60/40 Property Settlement?

A 60/40 property settlement is where one party receives 60% of the combined assets, with the other party obtaining 40%.

A property settlement is the process following separation or divorce where a couple formally divide their property, assets and liabilities.

The combined assets and liabilities of a couple are also known as the ‘asset pool.’

Is a 60/40 divorce split typical?

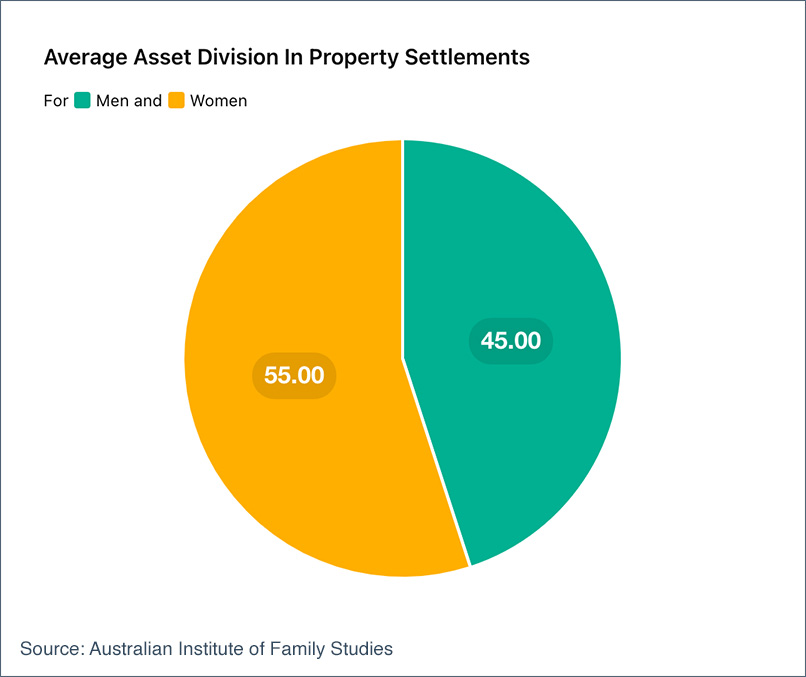

The Australian Institute of Family Studies report on the division of matrimonial property in Australia shows that, on average, women receive around 55% of the property and financial resources upon separation. This percentage increases significantly when financial resources such as superannuation are excluded from the pool of matrimonial assets.

So yes it is quite common.

Usually the 60% is received by the female member of the couple, and this accent tends to be made on the basis that she will:

- Be taking on the responsibility of raising children following separation, and / or

- Will have less income earning capacity, and/or

- May have less superannuation

It’s important to note that there is no fixed formula for determining how assets should be divided in a divorce, and the split will depend on a number of factors.

Some of these factors could include:

- The length of the relationship

- The financial circumstances of each party

- The contributions made by each party to the relationship (both financial and non-financial)

- The future needs of both members of the couple

- The overall fairness of the settlement

Rather than following a predetermined formula, the law considers various factors to determine a “just and equitable” distribution of assets.

How is the division of assets determined?

The division of assets during a property settlement is guided by a structured process, as follows:

Determine the “property pool”

The first step is to determine the "property pool." This involves identifying and valuing all assets, liabilities, and financial resources of both parties involved. The property pool can include real estate, bank accounts, investments, superannuation, and personal belongings.

Determine contributions made throughout the relationship

Once the property pool is established, the next step is to assess the contributions made by each party during the relationship. Contributions are categorised into financial, non-financial, and homemaker/parenting contributions.

Financial contributions include income, savings, and investments, while non-financial contributions cover aspects such as home renovations or managing the family business. Homemaker and parenting contributions recognize the effort put into caring for children and maintaining the household.

The aim is to evaluate the extent and impact of these contributions to determine their value in the overall settlement.

Determine future needs of each party

Working out what each party needs in order to move forward with their life is critical, and it is here that a weighting of 60% to one party often takes shape.

Determining the future needs involves considering factors such as age, health, earning capacity, and financial responsibilities.

For instance, if one party has primary custody of the children, their future needs might be greater due to the costs associated with raising the children. Additionally, any disparity in earning capacity, such as one party having limited work experience or requiring further education to re-enter the workforce, must be taken into account.

These factors often mean that the parent taking primary responsibility for the children will end up with 60% (or around) of the assets.

Determine a just and equitable settlement

The final step is determining what can be broadly considered a just and equitable division of the property pool. This decision is made after considering the contributions of each party and their future needs. The aim is to achieve a settlement that is fair and reasonable, reflecting the unique circumstances of the relationship and the needs of both parties. Again, this factor is not looking at the division through the lens of a specific ratio or percentage.

An example of a 60/40 divorce settlement

John and Mary Smith were married for 15 years and have two children, aged 12 and 9. John is a high-income earner working as an executive in a multinational company, while Mary took on the primary role of homemaker and primary caregiver to the children. The couple decided to divorce amicably, agreeing to prioritise the welfare of their children.

Financial Overview:

- Assets:

- Family home valued at $1,200,000 (mortgage-free)

- Investment property valued at $600,000 (mortgage of $200,000)

- John’s superannuation: $400,000

- Mary’s superannuation: $100,000

- Savings and investments: $200,000

- Liabilities:

- Investment property mortgage: $200,000

- Joint credit card debt: $20,000

- Total Net Assets:

- $1,200,000 (family home) + $400,000 (investment property equity) + $500,000 (superannuation) + $200,000 (savings and investments) - $20,000 (credit card debt) = $2,280,000

- $1,200,000 (family home) + $400,000 (investment property equity) + $500,000 (superannuation) + $200,000 (savings and investments) - $20,000 (credit card debt) = $2,280,000

Settlement Considerations:

- Contributions:

- John contributed financially as the primary income earner.

- Mary contributed as the primary homemaker and caregiver, supporting John's career and managing the household.

- Future Needs:

- Mary has a lower earning capacity due to her career break and the time required for primary caregiving.

- The children's needs, including stability in housing and education.

Settlement Agreement:

Through negotiations and mediation, the party decide that a 60/40 split in favour of Mary is just and equitable, as follows:

- Mary’s Share (60%):

- Family home valued at $1,200,000

- $100,000 in savings and investments

- $200,000 from John’s superannuation

- $100,000 from her own superannuation

- Total: $1,600,000

- John’s Share (40%):

- Investment property with $400,000 equity

- $100,000 in savings and investments

- $200,000 from his own superannuation

- Debt responsibility for $200,000 mortgage and $20,000 credit card debt

- Total: $700,000

The settlement reflects a 60/40 division, considering Mary's non-financial contributions and future needs.

Is Every Divorce Split 50/50?

No, not every divorce split is 50/50.

While some couples may choose, or end up with 50/50 split, others may agree on a different ratio based on their specific circumstances. See our article on a 50/50 divorce settlement.

However 50:50 is a common starting point for negotiations. And where a couple agree on a 50:50 division, then that can be formalised and settled on that basis.

How do you negotiate the division of assets?

The division of property and finances can be arrived at via letters of offer, neogitations in person, mediation, and/or through the courts. This process is known as a property settlement, and is a major aspect of what family lawyers specialise in.

Family Lawyers are specialists in determining your entitlements, and working to obtain finalisation of your matter. They can use negotiation, mediation, or action through the Courts. Ultimately they would have Consent Orders, a Binding Financial Agreement, or Court Orders as a way to formalise the terms.

Resources

The Court’s guide to when a couple can agree. Read here.

The Court’s guide for when a couple are unable to agree. Read here.

How are the assets actually valued?

Professional valuers, accountants, or independent experts may be consulted to determine the accurate value of each asset.

They consider factors such as market value, depreciation, and potential tax implications.

In some cases, assets may need to be sold to facilitate a fair division.

Different assets may have varying liquidity and tax implications, which can influence their ultimate value in the settlement.

How long does a divorce settlement take?

The duration of a divorce settlement process can vary depending on the complexity of the case, the willingness of both parties to cooperate, and the backlog of cases in the family court system. Simple, uncontested settlements may be finalised within a few months (or even weeks), while more complex cases can take significantly longer.

When couples are locked into protracted litigation and an inability to negotiate, property settlements can stretch out for years. This is relatively rare, but it does happen.

Factors such as the need for property valuations, financial investigations, and negotiations between the parties can extend the timeline.

FAQs

Which assets are considered after separation?

Assets considered in a divorce typically include properties, investments, businesses, vehicles, savings accounts, pensions, and personal belongings acquired during the marriage. Debts and liabilities are also taken into account when determining the overall asset division.

You can read the Federal Circuit and Family Court of Australia’s (FCFOA) resource about finances and property here.

Can you get divorced before the property settlement?

Yes, it is possible to get divorced before reaching a property settlement. However keep in mind that there is a limitation of 1 year to bring proceedings before the Court following divorce.

Can you get divorced without a property settlement?

Yes you can. The divorce and the property / financial settlement are treated as two distinct legal processes.

It is recommended to initiate the process of dividing assets before finalising the divorce. This is because the asset pool may undergo changes after separation, such as acquiring additional assets or receiving inheritances, which could be subject to division between you and your ex-partner.

Similarly, if one of you accumulates debt post-separation, it can have a significant adverse effect on the division of assets. By addressing the asset division promptly, you can ensure a fair and accurate assessment of the assets and liabilities involved, minimising potential complications and disputes in the future.

Is a 60/40 settlement affected by being defacto?

Australian family law recognises de facto relationships as being subject to the same principles of property division as marriages. A defacto relationship will need to have been at least 24 months in duration to be subject to Australian Family Law.

Key takeaway

It’s important to note that while a 60/40 split is a common proportional division of assets, it may not be appropriate in all cases. Each divorce is unique, and it’s important to seek the advice of a qualified family lawyer who can provide guidance on the fairest division of assets.

If you would like to discuss your options in regard to a property settlement or any aspect of Australian family law, please contact us today for a confidential discussion.